No products in the basket.

Since the first deadline in June during our grant payment checks with the CITB Grants Team on behalf of our clients, we have identified that numerous companies are not up-to-date with their 2024 levy returns—when they believed they were.

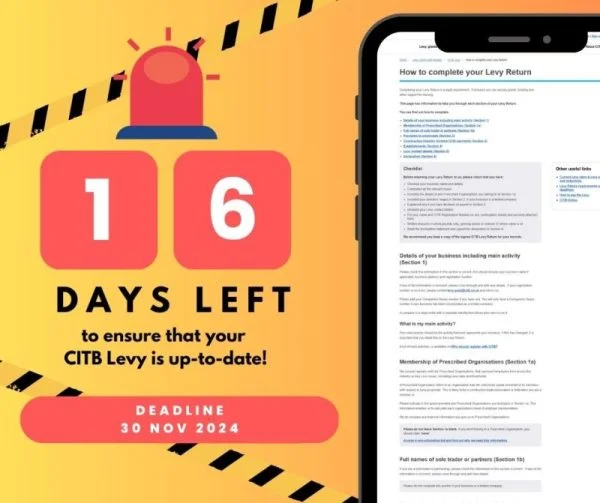

If your 2024 levy return is not sent by 30th November 2024, you will lose your eligibility for all grant claims until the next grant year, which starts in April 2025—even if you bring it up to date post-November 2024.

Don’t assume you’re up to date. Check whilst there is an opportunity to bring your CITB levy up to date. Every CITB levy-registered business must send their annual return even when exempt from payments. The only exception to this is when you are newly registered to the CITB levy and in your first year of registration.

Don’t get caught out.

Contact the CITB Levy and Grants team for assistance.

Need help and advice? Get in touch with our team.